Closing Market Recap

Today’s trading session delivered a broad range of outcomes, with small-cap names powering the upside while select technology and resource stocks lagged sharply. The benchmark indexes finished modestly higher, but individual movers stole the spotlight as investors rotated into niche growth segments and locked in gains in areas facing near-term uncertainties. Overall, the day underscored the continued bifurcation between momentum‐driven winners and fundamentally pressured laggards.

Top Gainers

Leading the advance, Silicon Storage Technology, Inc. (SSII) jumped a remarkable 34.47% to close at $9.09. With a Trade Engine Score of 35.07, the stock’s momentum appears driven by short-term positioning rather than a sustained liquidity surge, suggesting profit-taking could emerge in coming sessions. DigitalBridge Group (NYSE:DBRG) rose 15.71% to $13.48 on a 40.07 sentiment reading, benefiting from an uptick in M&A chatter within the data-center REIT space. Orla Mining Limited (NYSE:ORLA) added 14.27%, finishing at $13.13 on a neutral 49.99 score, as metal price strength fueled renewed buying interest in junior producers.

Polaris Inc. (NYSE:PII) climbed 13.92% to $69.90 after announcing the sale of a majority stake in its Indian Motorcycle brand. The multiple news items throughout the afternoon—including an upbeat analysis of the separation’s financial impact and neutral ratings reconfirmation—drove momentum, with a 50.04 Trade Engine Score pointing to a balanced risk/reward for follow-through. Albertsons Companies, Inc. (NYSE:ACI) rallied 13.63% to $19.26, lifting its full-year earnings outlook and unveiling an accelerated share repurchase plan. ACI’s 48.79 score underscores healthy conviction among buyers.

PureCycle Technologies, Inc. (NASDAQ:PCT) added 12.22% to $14.78 after securing REACH certification for its PureFive resin in the EU, an essential regulatory hurdle for European sales. TeraWulf Inc. (NASDAQ:WULF) rose 10.43% to $15.46 on 55.43 momentum points following the announcement of a $3.2 billion senior secured notes offering, which investors framed as a strategic move to expand AI‐focused infrastructure. DLocal Limited (NASDAQ:DLO) and Marathon Digital Holdings, Inc. (NASDAQ:MARA) gained 10.42% and 9.88% respectively, each closing above $15.60 and $22.24 as fintech and crypto miners attracted speculative flows. CleanSpark, Inc. (NASDAQ:CLSK) jumped 9.68% to $21.98, buoyed by robust Q3 revenue growth and commentary on bitcoin’s cycle dynamics—a narrative supported by its 63.26 Alpha Engine Score, signaling strong sustainability in today’s rally.

Top Losers

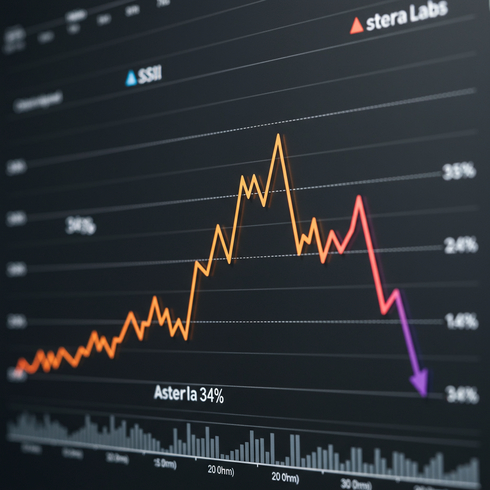

Astera Labs, Inc. (NASDAQ:ALAB) led decliners, plunging 14.13% to $171.33 despite joining the Arm Total Design ecosystem. The 54.44 momentum score hints that profit-taking overwhelmed the initial strategic benefits, as investors grappled with mixed signals on near-term chipset demand. Innodata Inc. (NASDAQ:INOD) fell 7.16% to $75.83 on a 62.32 score, weighed down by lack of fresh catalysts. Sierra Oncology, Inc. (NASDAQ:SRRK) slid 6.93% to $31.90 amid absence of new clinical data, with limited short-term conviction (41.20 score).

RTI Surgical Holdings, Inc. (OTC:RTNTF) declined 6.78% to $79.23 under a 35.75 sentiment backdrop, as investors questioned sustainability in the medical supply chain. Rayonier Inc. (NYSE:RYN) dropped 6.64% to $24.18 following confirmation of its all-stock merger agreement with PotlatchDeltic. While the deal offers an 8.25% premium, the 50.59 score reflects investor caution over integration risks and exposure to new tariffs on timber products.

Other mid-caps underperforming included GTBIF (-6.42% to $8.70), TGSGY (-6.31% to $7.71), ATHOF (-6.19% to $4.74), Berkshire Hathaway Inc. Class A (NYSE:RBRK) down 6.03% to $78.17, and Civitas Resources, Inc. (NYSE:CIVI) off 5.92% to $28.91. These stocks featured Alpha Engine Scores ranging from the low 30s to mid-50s, highlighting a mix of reactive selling and absence of supportive news flow.

News Flow & Sentiment Wrap-Up

Technology partnerships and regulatory approvals emerged as powerful catalysts today, with evergreen narratives around AI infrastructure, crypto mining, and specialty materials driving the winners. Sector rotation into small- and mid-cap growth names was evident, while merger announcements and franchise sales generated pronounced moves in consumer and industrial names like Polaris and Albertsons. Conversely, resource and healthcare segments without immediate news triggers ceded ground as traders refocused on near-term catalysts.

Investor sentiment skewed toward event-driven trades, with Alpha Engine Scores confirming that the strongest up-moves were backed by news headlines, and the steepest drops often followed deal-related or regulatory news. Overall, the market mood appeared opportunistic rather than broadly risk-on, suggesting pockets of strength and weakness will continue to emerge around specific catalysts.

Forward-Looking Commentary

Looking ahead, traders will watch next week’s economic calendar closely, including the release of consumer price index data and preliminary PMI readings. Q3 earnings from key technology and retail names could reinforce or counter today’s momentum in the small-cap growth universe. Central bank speakers are also on tap, and any adjustments to Federal Reserve guidance could ripple through rate-sensitive segments.

For now, stocks with trade engine scores above 60—such as CleanSpark and Marathon Digital—warrant attention for potential follow-through, while names like SSII and ALAB may face consolidation after today’s extremes. As sectors realign around fresh catalysts, selective positioning and quick reaction to news will be critical for navigating the coming sessions.