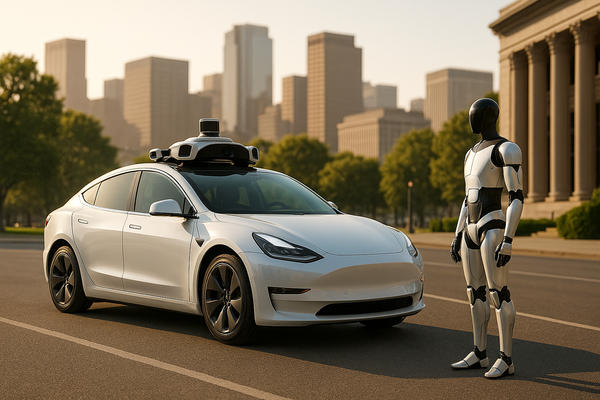

Autonomous mobility and robotics commercialization are crossing from promise to real revenue. Tesla (NASDAQ:TSLA) is running robotaxi rides without safety monitors and flagging price moves for Full Self-Driving. Waymo, an Alphabet unit (NASDAQ:GOOGL), is expanding paid robotaxi service into Miami. Nvidia (NASDAQ:NVDA) is shipping tools for the AV stack while chipmakers and cloud providers scramble to feed demand. This moment matters now because deployments are shifting risk from R&D timelines to regulatory, operational and infrastructure constraints. In the short term cities and insurers will test safety and coverage. Over the long term fleets, chips and power will determine which business models scale.

Two commercial models are emerging: closed fleets and software-as-service

Waymo’s expansion into Miami shows the closed-fleet playbook in action. Alphabet’s unit is widening a tightly controlled, geo-fenced service where the company controls hardware, operations and customer experience. That reduces immediate safety and regulatory friction. Meanwhile Tesla is pursuing an asset-light, software-first model. CEO Elon Musk and company announcements in Austin and at Davos report unsupervised robotaxi rides and near-term approval hopes for supervised Full Self-Driving in Europe and China. Tesla’s claims move the debate from prototypes to real rides and force regulators to respond.

Both approaches create different short-term winners. Closed fleets limit liability but require heavy capex and local permits. Software-led models can scale rapidly if regulators and insurers accept them. Lemonade (NYSE:LMND) already jumped on that opportunity by offering steep insurance discounts tied to FSD—illustrating how incumbents see quick monetization pathways beyond vehicle sales.

Monetizing autonomy: subscriptions, ride revenue and insurance partnerships

Tesla has repeatedly said it wants software to offset a weaker vehicle cycle. Announcements that FSD subscription prices will rise as capabilities improve signal an explicit monetization path. Those fees combine with robotaxi fares to create recurring revenue streams that look very different from one-time EV sales. Investors are watching whether FSD subscribers and ride revenue can scale fast enough to justify higher valuations.

At the same time insurers and third-party firms are lining up. The Lemonade tie-up and offers from specialty underwriters show the insurance industry is building products around software-driven risk profiles. Expect more bundling: subscription plus per-ride revenue shares plus mission-critical insurance. That mix will determine cash flow timing and how quickly market sentiment pivots from hype to durable business cases.

Optimus and humanoid robotics: a different commercialization cadence

Tesla’s Optimus humanoid robot updates and Musk’s public timeline—sales by 2027 in his statements at Davos—underline that robotics is now part of the same commercial narrative. Unlike vehicle autonomy, humanoid robots target factories, logistics and eventually households. That creates two consequences. First, expectations reset: robots will follow an S-curve of slow initial production, then rapid adoption in specific verticals. Second, revenue profiles differ—hardware sales, service plans, and vertical software solutions rather than per-ride fees.

Other players are building on this logic. Serve Robotics (NASDAQ:SERV) and logistics-focused robotics firms are pushing into hospitals and retail delivery, showing that real dollars can arrive sooner in narrow commercial niches than in general consumer robotics.

Chips, data centers and power: the infrastructure that will make or break scale

Nvidia is central here. The company’s new AV tools and continued GPU demand illustrate why compute is a gating factor. Nvidia (NASDAQ:NVDA) ecosystem announcements and partner moves matter because autonomous systems need massive onboard and cloud inference. Chip supply constraints and export politics complicate this. Alibaba (NYSE:BABA) preparing an IPO for its T-Head AI chip arm and Taiwan Semiconductor (NYSE:TSM) raising growth forecasts underscore global competition for advanced silicon.

Energy is the unsung bottleneck. Elon Musk has warned that electrical power, not compute alone, limits deployment. Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ:AMZN) pledging to self-fund power grids for data centers signals corporate recognition that compute growth requires matched energy capacity. That matters locally for power markets and globally for procurement of renewables, grid upgrades and permitting.

Market consequences and a practical investor lens

The commercialization of robotaxis and robots is already changing investor flows. Chip and infrastructure suppliers are benefiting as orders ramp, while legacy automakers face a product-and-service pivot. Nvidia’s leadership in AI chips and ecosystem tools, and Tesla’s experimental rollouts, are drawing capital and headlines in equal measure. But this is no longer only about winners in software or hardware; it is about orchestration across chips, cloud, power and regulation.

Short-term, expect volatility as regulators, insurers and cities respond to unsupervised robotaxi tests and as early Optimus units find niche use cases. Longer-term, the firms that align supply chains, secure compute and energy, and craft defensible software monetization will convert hype into revenue. That will reshape profit pools across automakers, chipmakers and cloud providers and will force established players to choose between defending legacy product margins or investing aggressively in new mobility services.

Autonomous mobility and robotics commercialization is now measurable in rides, trials and subscription announcements. The market’s next test will not be who talked the loudest about autonomy, but which players can synchronize hardware, software, and the grids that power them.