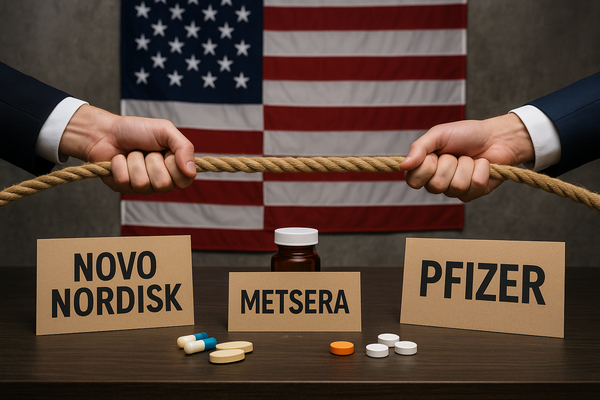

Novo Nordisk and Pfizer clash over Metsera acquisition. The escalating bidding war and lawsuit have been recast as an “America First” argument, with both firms lobbying the White House and Capitol Hill. In the short term, the contest is creating legal uncertainty for Metsera shareholders and volatility in small-cap biotech M&A sentiment. Over the long term, it signals how dealmaking, pricing concessions and direct government engagement could rewire drug-market access, Medicare coverage and antitrust scrutiny across the US, Europe and emerging markets. Compared with past pharmaceutical takeovers, political framing now matters as much as price. This matters now because competing bids and White House talks could reshape coverage and pricing in the coming days.

Escalating bids, legal suits and a political frame

Novo Nordisk (NYSE:NVO) surprised the market by offering up to $9 billion for anti-obesity biotech Metsera after the company had already agreed to a transaction with Pfizer (NYSE:PFE) worth up to $7.3 billion. Bids rose again: Pfizer increased its maximum to roughly $8.1 billion while Novo extended its offer to about $10 billion. The surge turned commercial competition into an aggressive legal and political contest.

Pfizer has filed suit alleging Novo’s merger agreement violates U.S. antitrust law and contends that Novo would impair an emerging U.S. competitor. Novo has called the complaint “false and without merit.” Sources say Pfizer has been pressing allies on the Hill and within the administration to bolster its case and to urge regulatory scrutiny. At the same time, Novo has argued its bid promotes patient access by expanding its product portfolio.

The public messaging is notable. Both companies are using how the deal serves U.S. patients and jobs as a lever. That turns a standard price-and-strategy negotiation into something with clear political ramifications, especially given recent and ongoing White House engagement with major drugmakers over prices and coverage.

Medicare deals, price concessions and investor reactions

The takeover fight comes while drugmakers negotiate pricing and coverage deals with the administration for GLP-1 and other weight-loss therapies. Pfizer was the first to announce an Oval Office-backed most-favored-nation style pricing agreement, and Novo is expected to unveil its own pricing and coverage announcement this week. Those deals trade some price concessions for broader Medicare and Medicaid access.

Investment banks and analysts are parsing how expanded coverage and steep discounts balance out. UBS highlighted a reported Medicare price for Wegovy of $149 per month. That compares with cash and commercial U.S. prices near $499 per month and higher list prices in parts of Europe — UBS cited roughly $314 in Germany and $350 in Denmark. The bank called the impact “mixed”: coverage will expand patient access and sales volume, but substantial discounts could compress margins and put pressure on commercial pricing.

Investors are watching two spillover questions closely. First, can manufacturers isolate deeply discounted Medicare pricing so it does not bleed into commercial or cash-pay markets? Second, will improved access lift long-term uptake enough to offset lower unit revenues? In the near term, M&A and pricing headlines are driving biotech valuations and volatility for obesity-drug peers, including Eli Lilly (NYSE:LLY), which competes in the same therapeutic category.

Regulatory playbook: antitrust, FTC posture and precedent

The legal fight spotlights antitrust enforcement in pharma M&A. Pfizer says it already cleared the purchase with the Federal Trade Commission historically for its deal, and it asked the courts and the FTC to weigh in on Novo’s counteroffer. Novo counters that blocking its bid would amount to suppressing competition from a global leader in obesity treatments.

This dispute follows a string of high-profile enforcement episodes in healthcare. Regulators have grown more willing to scrutinize deals where market concentration could harm innovation or patient choice. The practical outcome here will hinge on contract terms, overlap between portfolios (notably Wegovy and Ozempic), and demonstrated harm to competition. For investors, the case underscores a heightened regulatory premium on deals where product overlap or pricing power is evident.

Policy signals and the broader health-market backdrop

The Metsera fight is unfolding alongside broader healthcare policy noise that matters to markets. On Capitol Hill, Democrats won key gubernatorial races but face a hard choice over the Affordable Care Act subsidies: they may secure a vote but not a binding deal. That political uncertainty matters to insurers and managed-care firms because premium subsidies and coverage rules affect enrollment and profitability.

State-level fiscal pressures add another layer. Colorado’s governor proposed trimming Medicaid benefits, including adult dental caps and other limits, as federal funding declines under recent spending legislation. States such as North Carolina and Idaho have signaled cuts to provider rates. Reduced state spending, combined with federal subsidy uncertainty, will shape provider revenue and reimbursement trends for years to come.

Short updates that matter to market participants

Pfizer’s COVID vaccine sales are cooling after regulators narrowed shot recommendations. That has modest near-term revenue implications for PFE while shifting attention to other franchises and to M&A to fill revenue gaps. Separately, marketing claims about microdosing GLP-1s lack robust evidence, a reminder that clinical and regulatory validation remains central to durable uptake and pricing power for obesity drugs.

For dealmakers and investors, the sum of these developments is instructive. Large-cap drugmakers are using pricing concessions and White House engagement as transaction levers. Regulators and lawmakers are increasingly part of that calculus. The result is a market where political strategy, reimbursement deals and antitrust risk move in parallel with traditional business considerations like pipeline fit and price.

For market participants focused on healthcare equities, the immediate takeaway is twofold: watch the legal outcomes and the administration’s pricing announcements closely, and track whether discounted public programs lead to spillover into commercial pricing. Both outcomes will influence near-term revenue trajectories and longer-term valuation frameworks for major drugmakers and their biotech targets.