The U.S. labor market may be healthier than it looks but it could worsen quickly. A pronounced kink in the Beveridge Curve places job openings and unemployment at a fragile juncture. At the same time political turmoil in France has driven bond yields higher and rattled investor confidence about that country’s ability to shrink deficits. Both developments matter for markets.

The Beveridge Curve’s concerning kink

The Beveridge Curve captures the relationship between job openings and unemployment. Since 2000, when the pandemic period is excluded, this relationship has shown a notable nonlinearity. In recent years the curve moves from a mostly vertical segment to a mostly horizontal segment. That change implies the economy can tolerate sizable cuts to job postings in one regime and then become highly sensitive to small cutbacks in the other regime.

In August the job openings rate and the unemployment rate were both 4.3 percent. That point sits right at the kink where the vertical portion gives way to the horizontal portion. Historical patterns suggest that if employers pull back on hiring intentions even a little from that spot, unemployment can rise rapidly.

Private sector indicators point to further moderation in hiring. As of September 26, the Indeed Job Postings Index was down 2.5 percent from a month earlier. That decline is consistent with the gradual reduction in job postings since the openings rate peaked more than three years ago. Past experience shows modest pain so far for workers, but the kink in the curve increases the odds that further cutbacks will translate into sharper increases in joblessness.

What it means for policy and markets

Policymakers are already weighing this risk. Federal Reserve rate-cutting is discussed as a risk management decision intended to reduce the chance that unemployment spikes higher. With the labor market sitting at an inflection point, small changes in hiring behavior could have outsized effects on the unemployment rate. That dynamic helps explain why rate policy can appear cautious even when inflation remains elevated and financial markets are buoyant.

Economists see this as a critical moment. Observers say the chart suggests the economy could be near an inflection point where a floor under hiring is needed to avoid a more abrupt deterioration in employment. Markets will therefore treat incoming labor data with extra importance. A sequence of weaker hiring signals or lower job postings could push yields higher on expectations of weaker growth and raise equity volatility as investors reassess earnings prospects.

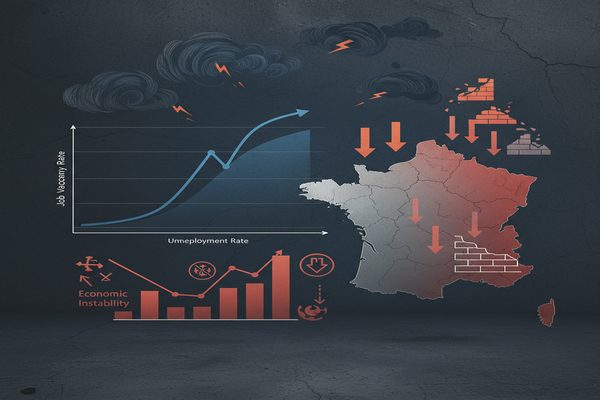

France’s fiscal and political breakdown

Across the Atlantic, France’s political dysfunction has intensified. The prime minister resigned this morning after less than one month on the job. This marks the fourth prime minister in the past year and the departing official was the shortest-serving premier in France’s history. The resignation came after efforts to secure a budget that would satisfy far-right politicians, voters and bond market demands failed.

The immediate market response was sharp. Stocks in France dropped almost 2 percent and yields spiked on French government bonds. The crisis has reduced investor confidence that France can implement the spending cuts and tax increases required to shrink deficits. That loss of confidence is central because debt markets react not only to fiscal numbers but also to the political capacity to deliver credible plans.

French President Emmanuel Macron has said he will not call snap elections or resign. If that stance holds, the risk remains that successive prime ministers appointed by the president could also fail to pass a budget. That scenario would prolong political uncertainty and keep upward pressure on yields until a credible fiscal framework is agreed.

Market preview for the coming trading session

Markets open the next session with two linked concerns. The U.S. labor story increases the odds that incoming American data will drive market moves. The position at the Beveridge Curve kink means that reports on job openings, payrolls and job postings will be watched for early signs of a turn. Traders should expect higher sensitivity in risk assets to labor data revisions. Equities could retrace gains if hiring indicators come in softer than expected. Bond markets may react by pricing in a weaker growth scenario which typically pushes long yields lower in the United States. At the same time, any clear deterioration could also prompt investors to question corporate profit paths and apply downward pressure on cyclical sectors.

European markets will trade under the shadow of France’s fiscal crisis. The nearly 2 percent drop in French stocks and the spike in sovereign yields are immediate signals that investors are reappraising risk in European government debt. Bank stocks and domestically focused sectors are likely to feel the most pressure. Contagion could spread to peripheral sovereigns if confidence does not stabilize. Traders will track French political developments closely for signs of a credible budget plan or a new government capable of delivering fiscal consolidation.

Currency markets may reflect divergent narratives. If U.S. labor data softens and the Federal Reserve is seen as more likely to ease policy to protect employment, the dollar could weaken against other major currencies. Conversely, renewed European fiscal stress could support the dollar and push the euro lower. Fixed income traders must balance these forces. In the short run, heightened volatility in sovereign curves is likely, with French yields leading moves and other eurozone yields following depending on perceived fiscal spillovers.

Sector implications are straightforward. Financials tend to be sensitive to rising yields and fiscal stress in major economies. Defensive sectors could outperform during risk off periods. Cyclical areas tied to hiring and consumer spending will be vulnerable if the U.S. labor market shows signs of deterioration. Commodities may respond to growth expectations. Equity investors should manage exposure with an eye on both macro data and political developments in Europe.

The coming session will test how much weight markets place on the labor market inflection and on political risk in France. Economic releases, private hiring indexes and political dispatches from Paris will all take on extra significance. Traders and portfolio managers should prepare for higher intra session volatility and be ready to adjust positioning as new data and announcements clarify whether the current fragility becomes a broader economic trend or remains a manageable risk.

Note on personnel changes. In an unconventional personnel move at the federal level, the Treasury Department announced that Frank Bisignano, who runs the Social Security Administration, will also be the CEO of the IRS in a newly created position. That development is part of broader changes in governance that markets will monitor for implications on tax administration and fiscal reporting.

Markets will open with questions rather than answers. The next set of data and political developments will determine whether the current environment is a period of contained risk or the start of a more pronounced repricing of growth and fiscal credibility.