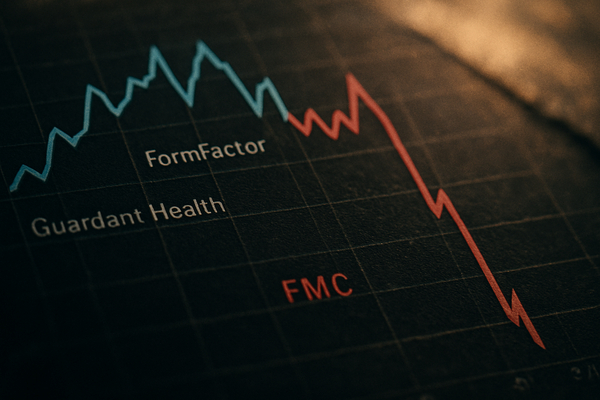

The market closed on a day defined by earnings-driven volatility, with outsized moves concentrated in companies that reported quarterly results or provided forward commentary. Guardant Health, Inc. (GH) led the advance, finishing at $92.41, up 27.87% on the session, while FMC Corporation (FMC) suffered the steepest drop, closing at $15.53, down 46.52%. Across the roster of top gainers and losers, the common thread was corporate results and guidance — beats were cheered only when paired with confident forward outlooks, and even positive prints were punished when executives tempered expectations.

Top gainers were dominated by names that delivered better-than-expected quarterly performance or encouraging outlooks. Guardant Health’s 27.87% surge to $92.41 followed a string of quarter-related disclosures that highlighted revenue and sales strength, and commentary that suggested momentum in key diagnostics markets. The Trade Engine Score for Guardant Health sits at 55.15, a middling read that signals solid technical and sentiment support but not an extreme, crowd-driven melt-up; the rise is meaningful but should be monitored for profit-taking into near-term resistance.

FormFactor, Inc. (FORM) was another standout, closing at $59.21, up 24.08% after reporting better-than-expected revenue and raising the next quarter’s guidance. FormFactor’s Trade Engine Score of 37.89 is below 50, indicating the move may be more event-driven than structurally entrenched, and traders should look for confirmation in follow-through volume and guidance revisions before adding exposure on momentum alone. Viavi Solutions Inc. (VIAV) also reacted positively to fiscal-quarter commentary, finishing at $17.10, up 22.32% with a Trade Engine Score of 43.66 that suggests room to run but also risk of short-term retracement.

Not all large winners had clear newsflow on the tape. Globalstar, Inc. (GSAT) climbed 22.24% to $50.78 without a linked headline in the provided feed, and MTSR’s 22.06% advance to $63.73 came with a zero Alpha Engine score, a red flag for liquidity- or headline-driven spikes in less-followed names. Investors should treat such moves cautiously; absent a durable fundamental catalyst, these gains can unwind rapidly. C.H. Robinson Worldwide, Inc. (CHRW) and Cardinal Health, Inc. (CAH) both enjoyed double-digit advances — CHRW to $154.88 (+19.71%) and CAH to $189.84 (+15.43%) — on quarter results that emphasized margin improvement and stronger-than-expected revenue, and their Trade Engine Scores in the mid-50s point to reasonably constructive momentum.

The session’s largest declines were anchored by company-specific disappointments. FMC’s 46.52% plunge to $15.53 was the most severe, driven by a combination of a leadership change and a dramatic revenue decline tied to one-time commercial actions in India that materially reduced reported sales. FMC’s Trade Engine Score is 21.75, below the 25 threshold, signaling a high probability that bearish momentum could persist beyond today as investors reassess both near-term execution and management continuity.

Other heavy losers were largely linked to mixed or disappointing earnings takeaways. Apellis Pharmaceuticals, Inc. (APLS) fell 30.99% to $20.74 with no headlines in the feed, indicating either sector contagion or a private catalyst not captured here. Sprouts Farmers Market, Inc. (SFM) dropped 26.11% to $77.25 after missing sales expectations and warning on same-store trends; its Trade Engine Score of 48.71 suggests that while the reaction was severe, the name may stabilize if subsequent comps or promotional responses prove effective.

Chipotle Mexican Grill, Inc. (CMG) closed at $32.53, down 18.18% after the company flagged a slowdown in comparable-restaurant sales and warned that rising costs and an intensified promotional environment could pressure near-term growth. The broad negative investor response despite largely in-line earnings highlights the market’s sensitivity to guidance and the premium investors ascribe to clear, unit-level momentum. eBay Inc. (EBAY) similarly slipped 15.88% to $83.73 after trading sharply lower in extended hours following mixed holiday-quarter guidance, underscoring how forward-looking commentary continues to outweigh historical beats in many cases.

Scanning the Trade Engine Scores provides useful nuance for sustainability. FMC’s sub-25 reading reinforces a biased view toward further downside absent a meaningful strategic update. Conversely, EMCOR Group, Inc. (EME) posted a 16.60% decline to $648 but carries a score of 74.07 — just shy of the 75 level that would mark a strong momentum signal — suggesting the sell-off might be counterintuitively nearer exhaustion than confirmation, and a rebound is possible if management’s outlooks hold. Many other movers carry mid-range scores (40–65), indicating today’s moves are real but will need follow-through from subsequent quarters or confirmation from peers to be durable.

In sum, earnings season remains the dominant narrative: companies that beat and raised guidance were rewarded, while those that trimmed outlooks or revealed execution issues were punished, sometimes harshly. Sector themes included healthcare and diagnostics strength juxtaposed against consumer and retail caution, with logistics and distributor names showing selective strength when margin commentary impressed. The presence of several large moves without clear headline support also points to episodic liquidity events and targeted flows that can exaggerate outcomes for small-cap or low-float names.

Looking ahead, traders should watch upcoming quarterly releases and management commentaries for confirmation of trends seen today, and pay close attention to macro datapoints and central bank commentary that could re-price risk appetite across cyclical and growth-sensitive names. Specifically, follow-through in Guardant Health, FormFactor and the logistics winners will depend on sustained revenue trajectories and margin expansion, while FMC’s path will hinge on clarity around management and the company’s India disposition. For names that moved without clear catalysts, liquidity and short-interest dynamics will be consequential. Overall, the day’s action is a reminder that in the current environment, earnings nuance and forward guidance — not just headline beats — are the decisive drivers of market direction heading into the next session.