Alcoa’s Kwinana shutdown reshuffles regional alumina capacity. The permanent closure (Alcoa, NYSE:AA) pushed AA shares up 6.2% on the announcement and matters now because it tightens supply in a market already sensitive to outages. Short term, it removes local refining output and pressures regional margins. Long term, it reduces global alumina capacity and forces asset reallocation. The move matters across regions: Australia loses refining jobs; Asian smelters will watch feedstock flows; Europe and the US will weigh import and inventory effects. Historically, similar refinery exits tightened spreads for months.

Micro shock: Alcoa (NYSE:AA) and immediate capacity effects

Alcoa’s announcement that the Kwinana alumina refinery will close permanently followed an earlier production curtailment. The stock reaction was swift: shares rose 6.2% on the news day. The local impact is concrete — jobs and supply contracts in Western Australia will be re-priced. On throughput, Kwinana’s exit trims Alcoa’s refining footprint, lowering near-term alumina availability.

Quantitatively, the 6.2% move contrasts with the metal-pack sector’s calmer days this month. If Kwinana represented even a mid-single-digit percentage of Alcoa’s refining output, regional alumina balances shift; buyers in Asia may chase replacement cargoes, lifting spot premiums. For downstream smelters, the short-term result is tighter feedstock optionality. Over quarters, Alcoa may redeploy capital or accelerate asset rationalization.

Oddball rally vs. pullback: Ardagh (NYSE:AMBP) and the contradictory signals

Ardagh Metal Packaging (NYSE:AMBP) shows a peculiar mix of metrics. Its 1-year total shareholder return is 10.7%, while year-to-date the stock is up 23.6%. Yet recent momentum cooled with a 7.6% one-session dip. Those three numbers pull in different directions for traders and allocators.

Volume and valuation clues matter here. The YTD 23.6% rise suggests substantive positioning into the story earlier this year, while the 7.6% drop implies a volatility pocket that could attract short-term liquidity flows. If institutional holders reacted by trimming at the dip, average daily volume and block trade counts could tell the tale — a gap between headline returns and recent selling intensity is the anomaly to watch.

What-if: a 7.6% pullback triggers a wider re-rating?

What if Ardagh’s 7.6% pullback prompted margin-sensitive funds to rebalance? In that scenario, a concentrated sell order equal to a small percentage of float could push price-to-earnings and enterprise-value multiples lower across small-cap packaging peers. A hypothetical run: a 7.6% drop followed by a 5% bid-ask widening might lead to cascading sold-lots from leveraged funds, temporarily lifting intraday volumes and compressing multiples by 3–5 percentage points. This thought experiment is not a forecast; it simply tests how a mid-size dip could transmit to peer valuations and liquidity metrics.

Sector spillovers: rare earths, copper, and mining movers

Policy moves and tariff rhetoric have pushed specialty metals into the spotlight. MP Materials (NYSE:MP) appears five times in recent headlines, a simple count that reflects concentrated attention. Southern Copper (NYSE:SCCO) staged a one-month surge of roughly 22% as the copper market priced in supply disruption and dividend appeal. That 22% bump is large for a major-mining name and shows commodity sentiment can amplify sector flows.

Linkages are notable. Rare-earth policy chatter lifted MP-linked news volume and rearranged relative flows toward strategic metals. Copper’s 22% one-month gain for SCCO likely changed analyst assumptions on near-term cash flow, pushing some price targets higher. For investors monitoring trading patterns, news-count multipliers and one-month returns are as telling as typical metrics like reserves or production guidance.

Analyst signals, dividends and market tone

Upgrades and cash returns create mixed signals. Crown Holdings (NYSE:CCK) was upgraded to Buy and sits at a Zacks Rank #2 per the announcement; that upgrade is a discrete datapoint investors use to recalibrate models. Meanwhile, Vulcan Materials (NYSE:VMC) declared a quarterly dividend of $0.49 per share, payable November 25, signaling cash-return continuity. On the other hand, Dow Inc. (NYSE:DOW) closed at $20.65 in a session that marked a -6.48% move, a sizable single-day swing for a blue-chip component.

These metrics feed into risk premia. A Buy upgrade can lift short-term recommended-weighted allocations, while a $0.49 dividend is a fixed cash yield that changes income-focused models. A -6.48% single-session drop for Dow compresses sector indices and can reset beta assumptions for cyclicals.

Connecting anomalies to investor behavior and positioning

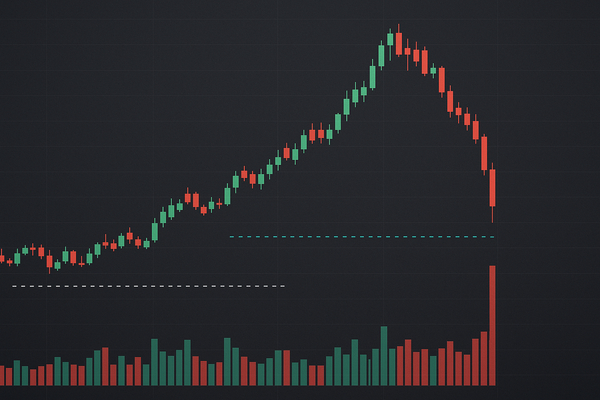

Putting the pieces together: a 6.2% pop on a plant closure, a 7.6% pullback inside a 23.6% YTD rally, five headline counts for MP Materials, and a 22% month-over-month copper move — these are fractured signals. They speak to liquidity vectors, concentrated news-driven flows, and episodic policy risk. Investors triangulate across such numbers when sizing positions and stress-testing portfolios.

Look for follow-up metrics to confirm directional bias: intraday and 30-day average volumes, block-trade counts, and any near-term production statements. Each numeric readout tightens the story that began at the micro level and expands into broader commodity and packaging markets.

Footnote: this commentary is informational. It links discrete data points and market reactions without providing investment advice.