Apple forecasts its best holiday quarter ever with double-digit iPhone and services growth, and investors are reacting now because earnings, regulation and deal flow are colliding ahead of year-end. Short-term the beat fuels tech leadership and risk-on flows; long-term it underscores services and device resilience versus cyclical hardware peers. The news matters in the US for investor allocations, in Europe for antitrust scrutiny and in Asia for partner deals that reshape fees and distribution. Compared with prior holiday seasons, Apple’s (NASDAQ:AAPL) mix tilt toward services is stronger, while split talk at other large-cap names mirrors 2024’s attention to liquidity events.

Market Pulse Check

Investors pulled money into software and networking names that signaled tangible AI demand while trimming the most stretched AI hardware rallies. Flows looked bifurcated. Institutional order books showed heavy demand for networking and cloud infrastructure exposure. Retail volumes stayed high in high-profile consumer names.

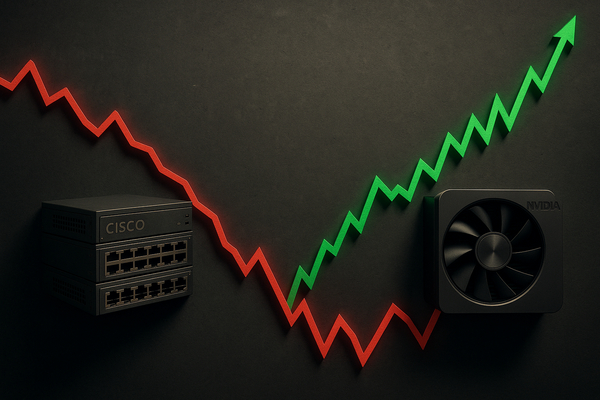

Two company examples illustrate the contrast. Cisco Systems (NASDAQ:CSCO) surged after a surprise earnings beat and stronger AI-networking orders, drawing institutional reweights. By contrast, NVIDIA (NASDAQ:NVDA) saw heightened volatility as investors debated valuation after a run-up in expectations.

Analyst Convictions

Analysts moved to reprice both winners and laggards. UBS raised its price target on Apple (NASDAQ:AAPL) from $220 to $280 after the quarter, citing stronger-than-expected services traction and iPhone demand. Morgan Stanley thrust Micron Technology (NASDAQ:MU) into a top-pick slot, calling a tightening memory market a potential earnings tailwind.

- Price-target changes: reflect reallocated risk budgets after Q3 and Q4 reports.

- Reiterated ratings: some firms kept neutral stances where revenue beat was offset by valuation concerns.

Those shifts reveal a split: higher conviction around durable enterprise demand for AI networking and memory, and more cautious views on richly valued pure-play AI hardware names.

Risk Events vs. Expansion

Legal and regulatory rulings collided with commercial expansions this week. A UK tribunal refused Apple’s (NASDAQ:AAPL) permission to appeal a ruling on app-store commissions, crystallizing regulatory risk in Europe. At the same time, Apple struck a 15% fee deal with Tencent (SEHK:0700.HK) for WeChat mini apps, opening a new revenue channel in China and easing local merchant friction.

Corporate actions also contrasted. Netflix (NASDAQ:NFLX) moved toward a stock split discussion after strong share-price gains, while Eli Lilly (NYSE:LLY) landed on split-watch lists as its price climbed. Those liquidity moves echo 2024’s pattern where splits altered retail demand and index weightings.

Meanwhile, Cisco’s (NASDAQ:CSCO) uplift shows expansion through AI-related product sales. The company raised guidance, citing hyperscaler orders and campus upgrades — an operational expansion story rather than a one-off re-rating.

Leadership and Fundamentals

Leadership changes and fundamental stories diverged across names. Berkshire Hathaway (NYSE:BRK.B) drew attention after reports it sold Apple (NASDAQ:AAPL) and Bank of America (NYSE:BAC) stakes in the quarter, a portfolio reshuffle that raises questions about passive versus active rebalancing at scale. Separately, Berkshire’s succession planning remains a corporate-governance focal point.

At the same time, IBM (NYSE:IBM) and other legacy tech players used product roadmaps — quantum and enterprise AI — to shore up narratives that fundamentals are still evolving even as market headline risk persists. Palantir (NYSE:PLTR) leadership commentary highlighted divergent CEO messaging versus analyst caution on valuation.

Investor Sentiment

Institutional investors and retail traders reacted differently. Institutions favored names with clear, monetizable AI demand (networking, memory, cloud services). Retail activity concentrated in marquee consumer and AI plays, keeping implied volatility elevated in those names.

- ETF and flow signals: tech-heavy indices outperformed broad crypto-linked benchmarks this year, and the Nasdaq’s gains have outpaced Bitcoin year-to-date.

- Retail resilience: despite pullbacks, retail buying persisted in selected high-profile stocks such as Tesla (NASDAQ:TSLA), which remained heavily traded even as shares slipped on profit-taking.

The result is a valuation disconnect in some cases: strong fundamentals but muted price response where legal or regulatory clouds hang; conversely, high momentum but stretched multiples in headline AI winners.

Investor Signals Ahead

Contrasts between upgrades and downgrades, rulings and new deals, and leadership moves versus product-driven growth are sending clear signals this month. Expect investors to watch liquidity events, regulatory milestones and measurable AI order flow for clues about which themes sustain support. These contrasts could reshuffle relative performance across large-cap tech, networking and memory segments as year-end rebalances and earnings catalysts approach.

Gaps remain in public reporting — for example, exact share-sale details from large holders or complete revenue splits from recent partnership agreements — so market responses will continue to digest discrete updates rather than a single, unified trend.