Lead with the data

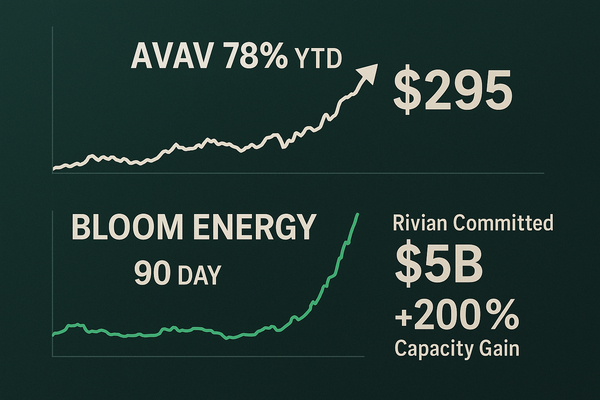

AeroVironment (AVAV) shares have exploded 78.0% year-to-date and 52.4% over the past 12 months, including a 14.6% jump in the last week and a 19.9% gain in the past month, while Stifel kept a Buy rating with a $295 price target on September 10; the firm cited better-than-expected Q1 sales growth and a reiteration of fiscal-year guidance for both sales and EBITDA.

AeroVironment: momentum quantified

AVAV’s cadence of moves is measurable: 78.0% YTD appreciation has compressed implied upside relative to the $295 analyst target, yet the market continues to re-rate the name after management confirmed its fiscal-year projections. Volume and volatility spiked alongside the 14.6% weekly gain, and the 19.9% monthly lift underlines the short-term momentum traders are exploiting — the stock now trades with elevated beta versus the market, and any quarterly result that misses the reiterated sales or EBITDA range would likely translate into double-digit intraday moves given the recent pattern.

Bloom Energy: a technical and narrative breakout

Bloom Energy (BE) delivered a different type of re-rating: the stock surged 90.8% in the past 30 days and has produced a cumulative return of 263.4% over a longer horizon cited by the market commentary. That 90.8% one-month move pushed BE into the crosshairs of macro and thematic buyers; Jim Cramer publicly hailed the company as “one of the great success stories,” a qualitative endorsement that accompanied the numeric rally and likely amplified retail and momentum flows.

Valuation and earnings context for Bloom

Despite the 90.8% month-over-month advance, Bloom’s fundamentals remain under scrutiny: the company historically reported net losses across multi-year windows, a point Cramer acknowledged when he said he had earlier overlooked the stock because it had been a “chronic money loser.” The market is now pricing a recovery: a 90.8% monthly spike implies the market expects revenue and margin inflection. For traders, the math is stark — if Bloom’s next quarterly release fails to show accelerating revenue or narrowing losses by single- or double-digit percentage points, the upside priced into a 90.8% move could reverse quickly.

Rivian’s $5 billion factory and near-term capacity math

Rivian (RIVN) reinforced the supply-side story on the ground: the company announced a $5.0 billion Georgia manufacturing plant that management says will increase assembly capacity by nearly 200% and is expected to create more than 15,000 jobs by 2030. The market responded: RIVN shares rose 6.8% on the groundbreaking announcement and have shown month-to-date upticks consistent with capacity-driven re-rating. A near-200% capacity increase implies a step-change in unit economics if utilization ramps toward mid-teens to 20% operating leverage on fixed-cost absorption — the key determinant of whether that $5.0 billion investment translates into margin expansion or cash-burn pressure in the coming 12–36 months.

Institutional positioning: why 87% matters

Capital flows are a second-order effect that can amplify all three stories: Ameren (AEE) and Exelon (EXC) each report 87% institutional ownership, and M&T Bank (MTB) sits at 89% institutional ownership — figures that illustrate how concentrated large-cap utilities and financials already are in institutional hands. When institutional ownership exceeds ~80%, blocks of shares move in larger increments; for AVAV, BE and RIVN this means a single re-rating or a cluster of buy-side reallocations can produce the 14–90% moves we just observed. Institutional concentration makes these names more sensitive to quarterly beats/misses and to headline-driven position changes measured in percentage-point shifts of ownership.

Trade and portfolio implications — numbers guide decision-making

For active traders, the numeric signals are clear: AVAV’s 78.0% YTD and $295 price target from Stifel set a measurable risk/reward framework; a pullback toward the 20%–30% intraday correction range would offer a chance to align positions with that $295 threshold. Bloom’s 90.8% monthly surge creates a two-tier trade: momentum traders target further upside with tight stops given the magnitude of the move, while value-oriented allocators demand demonstrable improvement in quarterly revenue growth or a pathway to positive free cash flow before stretching valuation multiples. Rivian’s $5.0 billion capex and nearly 200% capacity gain are quantifiable commitments — investors should model a 3–5 year capex-to-EBITDA breakeven and stress-test scenarios where utilization stays below 50%, which would extend the payback beyond the current market’s implied timeline.

Bottom line with numbers to watch

Key numeric checkpoints for the next 90 days: AVAV needs to hold momentum against the $295 price-target narrative and sustain the sales/EBITDA trajectory it reiterated; Bloom must convert the 90.8% monthly re-rating into sequential revenue growth and narrowing losses to justify a 263.4% long-term rerate; Rivian must show factory capex execution on the $5.0 billion Georgia project while moving utilization materially above single-digit rates to realize the near-200% capacity lift. Monitor institutional ownership shifts (87% and 89% reference points), quarterly revenue and EBITDA beats or misses (measured in percentage-point beats relative to guidance), and intraday moves in the 10%–20% range that will define short-term trader behavior.

Numbers don’t lie: 78.0%, 90.8%, $295, $5.0B, ~200% and 87% are the metrics rewriting investor priorities this quarter. Use them as your checklist when sizing positions, setting stops, and modeling downside scenarios over the next two earnings cycles.