AST SpaceMobile schedules a November 10 quarterly update that matters to investors tracking connectivity infrastructure and cloud gaming. The company (NASDAQ: ASTS) will host a business update on Monday, November 10 at 5:00 p.m. ET. That timing places AST SpaceMobile in the run-up to a busy earnings window where roughly $15 trillion of market capitalization among large tech names is reporting results. In the short term, the call could sway sentiment for small-cap satellite and connectivity plays. Over the long term, execution on consumer-facing, space-based cellular broadband will influence addressable-market estimates for direct-to-smartphone services.

Globally, space-based coverage could alter availability in emerging markets across Africa and parts of Asia. Locally, U.S. carriers and content platforms are watching partnerships and spectrum strategies. Compare that to recent infrastructure moves: EchoStar has rallied about 151.95% over 90 days, while Lumen announced a $200 million Palantir partnership and expanded Internet On-Demand to more than 10 million U.S. business locations. Those numbers show investor appetite for connectivity deals that support cloud gaming and high-bandwidth applications. The AST update is timely because investors are pricing capital spending and service rollouts into valuations now, not later.

Big tech earnings and AI spending set the tone

Wall Street is focused on AI-driven ad and cloud revenue as the Magnificent Seven file quarterly results. Analysts expect Meta to report about $49.5 billion in sales for the September quarter, according to FactSet estimates cited this week. Alphabet shares recently cleared the $264 level as traders load into the stock ahead of results. In addition, reports show Qualcomm stock jumped more than 20% after unveiling new AI chips for data centers, signaling elevated investor interest in semiconductor suppliers to cloud and gaming ecosystems.

Those dynamics matter to game and content companies because higher ad and cloud revenues fund platform investments. JPMorgan and KeyBanc have raised targets on AI beneficiaries, and markets are pricing capex increases for servers and data centers into multiples. For context, some large-cap names account for a big portion of index moves during earnings weeks when AI commentary is strong.

Content and game-cycle performance: engagement, ads and elastic revenue

Content owners and game platforms reported mixed signals this quarter. Netflix’s stock plunged about 12% after Q3 results, the market reaction driven in part by a surprise Brazilian tax item that dented operating income. Management said ad sales doubled in the quarter and engagement metrics remained strong, but the headline miss still triggered heavy selling.

On the gaming front, Roblox and larger publishers face scrutiny on bookings, DAUs and monetization. Roblox (ticker RBLX) has a Q3 preview in circulation, and two publisher-focused ETFs and notes — including VanEck’s ESPO — argue the game cycle and AI adoption could support further upside. EA and Take-Two were referenced in sector commentary this week; both companies remain on investor watch lists ahead of console and mobile release schedules. Meanwhile, Warner Bros. Discovery has been a bellwether for content-value realization: the stock is up about 98.4% year-to-date and jumped roughly 15.4% in the past week as takeover chatter intensified. Those moves feed valuation comparisons for studios that license game IP and streaming windows.

Connectivity, cloud gaming and space-based networks

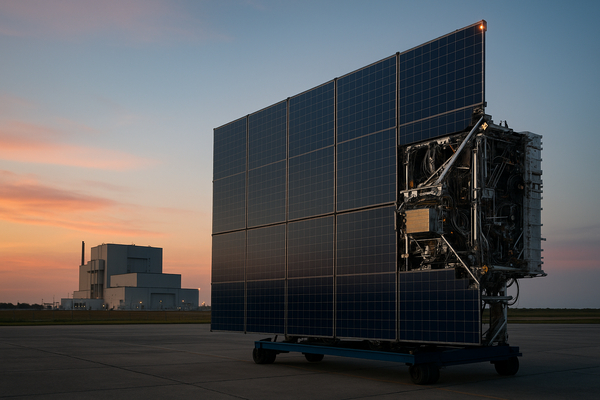

Infrastructure developments are directly tied to gaming performance because low latency and wide coverage enable new product forms. AST SpaceMobile’s Nov. 10 update (NASDAQ: ASTS) is therefore noteworthy. The company is building the only space-based cellular broadband network designed for direct smartphone connectivity. Investors will watch any customer rollouts, commercialization milestones and capital requirements disclosed on the call.

Other recent data points: EchoStar (ticker SATS) surged about 151.95% over 90 days, reflecting investor enthusiasm for satellite plays. Lumen Technologies signed a $200 million multi-year deal with Palantir and expanded Internet On-Demand to more than 10 million U.S. business locations, a measurable increase in addressable endpoints. Telecoms are active too: Verizon set an earnings date for October 29 and announced an agreement to acquire Starry to expand fixed wireless broadband. Those numbers highlight how fiber, edge networks and satellite links are aggregating to support cloud-native gaming and streaming workloads.

Distribution, ad monetization and strategic partnerships

Distribution channels remain a battleground. Comcast rolled out an expanded NOW TV Latino offering and pushed more live fútbol channels and value features in its bundle this week. Universal Orlando and other experiential businesses are changing pricing and ticketing policies, which affects content owners and distribution partners that monetize live and recorded experiences.

Analysts also moved on legacy media names: Mizuho and Citi raised Disney’s price target from $140 to $145, reflecting confidence in recent partnership initiatives such as the Disney–Formula 1 collaboration for the Las Vegas Grand Prix. IMAX signed a 17-location deal with Cinemark to add IMAX with Laser and IMAX 70mm systems, a clear, quantifiable expansion of premium exhibition footprints that feeds revenue per attendee. In addition, Comcast’s roster sponsorships for the 2026 Olympics and Warner’s takeover interest are tangible items that change advertiser allocation and content licensing flows.

In short, the interplay between AI-driven ad revenue, infrastructure deals and measured content monetization is producing discrete moves across stock prices and partnerships. Short-term volatility already shows up in share reactions — Netflix down ~12% post-result, EchoStar up ~152% over 90 days, Warner Bros. Discovery up ~98.4% YTD — while long-term investor focus centers on execution of network rollouts, ad-growth traction and licensing economics. The AST SpaceMobile update on November 10 arrives into that mix with an explicit timetable for the market to re-assess commercial progress and capital needs.