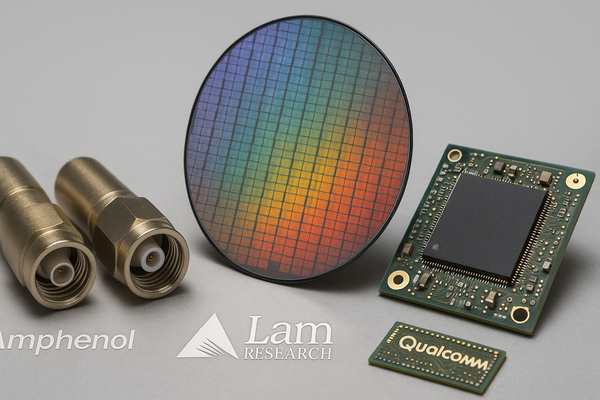

Amphenol, Lam Research and Qualcomm show mixed momentum across hardware and semiconductor supply chains right now. Amphenol (NYSE:APH) is drawing fresh analyst upgrades as hyperscaler demand and a large dividend boost accelerate investor interest. Lam Research (NASDAQ:LRCX) has sprinted higher this year on AI-driven capex, raising valuation questions in the short term but strengthening its long-term market position. Qualcomm (NASDAQ:QCOM) faces an immediate catalyst with earnings due in the next 24–48 hours, which could reset sentiment globally. Short term, earnings and sentiment swings will move shares. Long term, secular trends—cloud infrastructure, AI compute and edge adoption—remain the core drivers across regions from the US to Asia and emerging markets.

Market context and headline signals

The information-technology hardware complex is benefitting from renewed hyperscaler spending, secular AI demand and policy support for domestic chip ecosystems. However, valuations reflect those expectations. Technical indicators show strong upward momentum in Lam Research and resilient positioning for Amphenol. Macro sensitivity remains high: US capex cycles and Asian fab investments matter most. Meanwhile, workforce and talent initiatives—like the newly announced Semiconductor Pathways Fund—target a structural bottleneck that could support capacity expansion and long-term revenue growth for equipment and component suppliers.

Amphenol (NYSE:APH): Analyst upgrades, dividend boost and structural demand

Amphenol is trading at $136.70 with a 50-day EMA of 114.66 and a 50-day SMA of 113.82, and a 52-week range of 56.45 to 141.72. The stock’s RSI sits at 63.12, technical score is 63.88 and fundamental score is 82.00—a combination that points to healthy momentum underpinned by solid fundamentals.

Analysts are bullish: an analyst score of 85.71 across 20 coverage firms, with price targets spanning 85.85 to 171.15 and a mean near 145.20. News flow is unanimous positive (sentiment score 100.00), driven by strong IT and datacom demand and reports of increased hyperscaler activity. Management has reinforced capital deployment, evidenced by sizable dividend increases and targeted debt offerings to fund strategic growth.

Key strengths: broad end-market exposure to cloud and enterprise networking, robust fundamental metrics (profitability 100.00%, growth 83.35%) and a letter score of A-. Watch risks: stretched near-term multiples in pockets of the supply chain, and execution on large debt-funded expansions. Short term, upgrades and sentiment will keep attention on Amphenol. Over the long term, persistent hyperscaler capex supports durable revenue pools across regions.

Lam Research (NASDAQ:LRCX): Rapid gains, stretched indicators and secular positioning

Lam Research has delivered a dramatic run this year, trading at $155.78 with a 50-day EMA of 116.84 and SMA of 110.41. The 52-week band runs from 56.32 to 165.22. RSI is elevated at 86.01, technical score 77.34 and fundamental score 77.40. Year-to-date performance is notable—LRCX has rallied sharply as the market prices in AI-driven wafer fab expansions.

Analyst backing is unanimous and strong (analyst score 100.00 from 33 analysts), with a mean target of 160.70 and a median of 168.30. News narratives highlight Lam’s central role in advanced process tooling and a 117% YTD surge that has investors debating valuation vs. growth runway. Trade-engine and sentiment metrics are robust (trade engine 77.12; sentiment 82.00), but earnings quality is middling (48.32), suggesting volatility if revenue recognition or cycle timing disappoints.

What to monitor: order backlogs from leading foundries, capex cadence from AI chipmakers, and gross-margin durability as tool deployments scale. In the short run, stretched technicals raise pullback risk. Over multiple years, Lam’s competitive moat in critical fab equipment positions it to capture a large share of incremental wafer fab spending globally.

Qualcomm (NASDAQ:QCOM): Earnings cadence and edge momentum

Qualcomm closes at $172.84, with a 50-day EMA of 162.07 and SMA of 159.47; its 52-week range is 120.80 to 205.95 and RSI sits at 62.21. Fundamental score is 81.03 while technical score is lower at 27.43, reflecting mixed short-term technicals amid solid fundamentals. Growth metrics (growth 91.15%) and capital allocation (21.34%) highlight heavy reinvestment and R&D intensity.

Earnings are imminent—Qualcomm is scheduled to report within the next 24–48 hours. Consensus revenue estimate is roughly 10.99 billion. Street sentiment is high (sentiment score 100.00) and analyst coverage is deep (34 analysts; mean target ~183.98). Recent product and partnership news—such as new edge AI integrations and the Dragonwing collaboration highlighted by Advantech—underscore Qualcomm’s push into next-gen edge processors and ecosystem plays.

Key scenarios: a beat on revenue or guidance could lift peers tied to mobile and edge compute; a miss or cautious guidance could pressure not only QCOM but also supplier equipment and component names exposed to mobile cycles. Given Qualcomm’s global exposure, results will matter for US, Asian handset OEMs, and broader edge adoption in emerging markets.

What investors and traders should watch next

- Near-term catalysts: Qualcomm’s earnings release and any fresh commentary on hyperscaler demand from Amphenol or order trends for Lam Research.

- Technical pivots: pay attention to RSI extremes (Lam Research) and 50-day EMA crossovers (Amphenol) for short-term entry/exit signals.

- Macro & policy: US semiconductor workforce initiatives and regional capex incentives could alter long-term capacity plans and supply-chain allocation.

- Analyst behavior: upgrades and target revisions—already visible for Amphenol and Lam—can drive compression or expansion of price ranges quickly.

Bottom line: the trio illustrates where demand and valuation tension meet. Amphenol benefits from durable data-center and network demand with strong analyst support. Lam Research rides a powerful AI-driven capex wave but now carries stretched technicals. Qualcomm is the immediate event risk/reward with earnings that can set tone across the hardware complex. Globally, secular drivers favor these names over the long run, but near-term earnings, guidance and technical indicators will govern performance in the coming days and weeks.