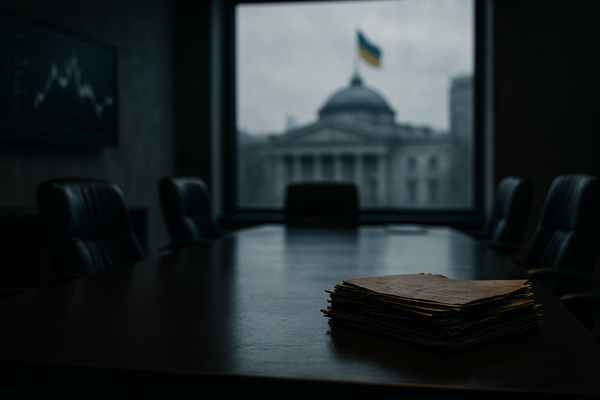

IMF mission teams started talks with Ukraine on a new lending programme while a widening corruption probe has shaken confidence in Kyiv. This matters now because IMF backing is central to Ukraine’s wartime financing and the probe could slow or condition disbursements. In the short term markets will watch conditionality and political fallout. In the long term the deal will shape reconstruction funding, European support and investor appetite across emerging markets. Globally, Europe and the United States face fiscal and geopolitical exposure. Historically the IMF has tied aid to governance reforms, raising stakes for Kyiv’s reform agenda.

IMF talks and the immediate stakes for Ukraine financing

The opening of formal talks between the International Monetary Fund and Kyiv comes at a delicate moment. Ukraine needs steady external financing to sustain defence spending and civilian services while the corruption probe tests domestic consensus for reform. The timing is critical. Fund teams tend to link disbursements to measurable governance steps. That linkage can accelerate reforms or complicate access to cash if political traction is weak.

For markets this is not just a sovereign credit story. Short-term liquidity for Kyiv influences eurobond markets, the sovereign yield curve and the willingness of bilateral and multilateral partners to step in. For governments and investors in Europe the question is whether conditionality will delay aid flows or produce a clearer reform road map that lowers risk over time. Emerging market investors will also weigh any precedent for stronger conditionality tied to corruption probes.

Political shocks and the broader implications for European support

The probe into high level corruption in Kyiv has already eroded trust at a sensitive junction. Political instability can increase the perceived risk premium on Ukraine assets and complicate coordination among donor countries. The European Commission has outlined options for financing Ukraine, and the European Union leadership has said combinations of grants, loans and other mechanisms could be used to meet needs. That debate will take place in a context where the IMF’s posture influences what bilateral partners are prepared to provide and on what terms.

In addition to fiscal support, confidence in governance affects reconstruction plans. Donor governments will want stronger assurances of transparency before committing large-scale, long-term funding. The present probe makes immediate commitments less likely unless Kyiv can show credible steps to shore up institutions and prosecute wrongdoing where it occurs.

Banking sector news and market tone

Financial stocks weighed on the FTSE 100 as investors digested economic data and sector-specific headlines. European banks have remained a key focus after reports that UBS (NYSE:UBS) reaffirmed its Swiss base following speculation about a possible U.S. move. That confirmation is intended to calm clients and regulators by signaling continuity of home-market operations.

Meanwhile Deutsche Bank (FRA:DBK) said it is shifting to a more offensive strategy and unveiled new goals that aim to reset investor expectations. The bank’s repositioning reflects broader industry pressure to restore profitability and reassure shareholders. Responses from investors to strategic resets can be uneven, often depending on near-term guidance and capital targets.

These banking stories sit alongside wider equity market drivers. Large cap technology names are again in focus with data and earnings schedules that can set market direction. Nvidia (NASDAQ:NVDA) headlines were flagged by market commentary as a near-term catalyst that could influence risk appetite across equities and derivatives markets.

Central bank and governance developments that shape market expectations

US Federal Reserve governance and policy commentary also featured in the briefing. A former Fed governor left under scrutiny for trading activity, a development that highlights the importance of institutional probity in central banking. Separately, public comments from a regional Fed official argued for caution on further rate cuts, a view that markets will note as they price the path of interest rates.

These governance and policy signals matter because they influence the pricing of interest rate risk and risk assets globally. If the Fed signals a more gradual approach to easing, that can support the dollar and pressure duration-sensitive assets. At the same time governance problems at key institutions can erode confidence and increase volatility in credit-sensitive sectors.

Corporate moves, investor flows and market scenarios

Corporate activity continues to shape sector narratives. L’Oréal (EPA:OR) increased its stake in a Chinese skincare company, reflecting the continued premium on growth exposure in Asia for global consumer brands. Such deals feed into debates over consumer demand dynamics in China and the strategic value of local partnerships for Western firms seeking market share.

On the capital flows front, reports that a high-profile US political figure has bought at least $82 million of bonds since late August were noted for their potential to affect secondary market liquidity in specific maturities. Large individual purchases can alter supply and demand in pockets of the Treasury market, even if they do not change the broad macro trajectory.

Putting these threads together shows a market environment where political and governance risks intersect with policy signals and corporate activity. In the short term markets will react to headlines about the IMF-Ukraine talks, bank strategy updates and central bank commentary. Over the medium term the outcomes will hinge on whether reforms and policy clarity reduce risk premia and encourage steady financing of public and private investment.

What to watch next

Key near-term items include progress reports from IMF-Ukraine negotiations and any public steps Kyiv takes to address the corruption probe. Market participants will also watch earnings and guidance from major banks and corporate licensors that affect regional indexes. Central bank commentary on the timing of rate moves will remain a core driver of cross-asset positioning.

Ultimately the situation is a reminder that financing and governance are connected. For Ukraine and its partners the immediate challenge is securing sufficient liquidity while rebuilding institutional credibility. For investors and policymakers in the US, Europe and Asia the task is to assess how conditionality and political developments will alter capital flows and risk pricing in the months ahead.