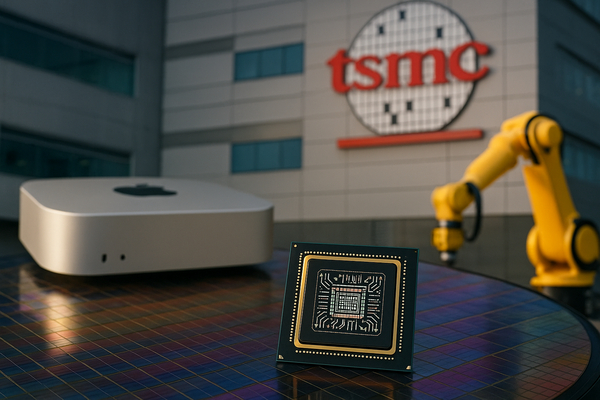

TSMC posts record Q3 profit as AI demand surges. Taiwan Semiconductor Manufacturing Company (NYSE:TSM) reported third-quarter net profit of NT$452.3 billion (US$14.7 billion), up 39.1% year-on-year. The move matters now because AI model deployment and iPhone demand are driving near-term fab utilization and a renewed capex cycle. Short term, customers are scrambling for capacity; long term, structural demand for advanced nodes and packaging is rising. Globally, the result lifts chip-equipment suppliers and data‑center builders in the US, Europe and Asia. Locally, TSMC’s ADRs are trading at multi-decade premiums, signalling strong foreign demand compared with the Taipei listing.

“TSMC’s Q3 surge: numbers, drivers and market ripple effects”

TSMC’s third-quarter net profit of NT$452.3 billion beat consensus and set a quarterly record. The company said profit rose 39.1% from a year earlier. Management pointed to booming demand for chips used in smartphones and AI accelerators. Analysts flagged that AI inference and training workloads are now a meaningful share of high-performance node mix.

That demand is visible across markets. TSMC ADRs have outpaced its Taipei shares, with ADR flows pushing a premium that is the highest on a 50-day moving average since 2002. Global buyers are reallocating capacity via ADRs and cross‑listing vehicles, lifting foreign investor interest in Taiwan manufacturing capacity.

The immediate effect is stronger order books for equipment makers and material suppliers. Applied Materials (NASDAQ:AMAT) and Lam Research (NASDAQ:LRCX) have seen higher investor attention. Memory and wafer‑fab equipment cycles are already reacting: DRAM pricing momentum lifted optimism at Micron (NASDAQ:MU), where Morgan Stanley recently raised its stance and price targets for DRAM upside.

“Apple’s product push, M5 chip and production moves”

Apple (NASDAQ:AAPL) on Oct. 15 unveiled the M5 chip and refreshed premium hardware ahead of the holiday quarter. Apple said M5 uses third-generation 3-nanometer technology and introduces a next-generation 10-core GPU architecture with a Neural Accelerator in each core. Apple claims M5 delivers over 4x peak GPU compute versus M4, with the new 14-inch MacBook Pro offering up to 3.5x AI performance and up to 1.6x faster graphics versus the prior generation.

The M5 rollout spans Mac, iPad Pro and Vision Pro. Apple also updated Vision Pro with improved power and a new Dual Knit Band and released visionOS 26 with widgets and Personas. Apple describes these upgrades as targeted to speed AI workflows on-device and in mixed-reality use cases.

On supply chain strategy, Apple is shifting some smart‑home and accessory production to Vietnam and expanding assembly with BYD (OTC:BYDDY) for select devices from 2025. CEO Tim Cook also signalled continued investment in China while responding to US tariff pressure. Separately, Apple said it added 650 megawatts of renewable capacity in Europe and plans more in China to support manufacturing and charging demand.

Market signals are mixed. UBS reports iPhone 17 wait times are flat to lower week‑over‑week across major geographies, while other data show pockets of stronger demand that Apple calls a resilient premium mix. The net effect is higher component demand for advanced nodes and packaging, which benefits contract foundries and chip‑making suppliers.

“Wider market implications: data centers, trade tensions and capital flows”

The AI infrastructure grab is accelerating. A BlackRock‑led investor group including Microsoft (NASDAQ:MSFT) and NVIDIA (NASDAQ:NVDA) agreed to buy Aligned Data Centers for about $40 billion, underscoring hyperscaler appetite for rack-level capacity and power. That deal dents available commercial capacity and feeds back into semiconductor and equipment orders.

Meanwhile, geopolitical friction matters. U.S.-China trade steps and tariff talk — including headlines of potential tariff increases referenced in recent market coverage — are prompting companies to diversify production. Apple’s Vietnam move and increased China investment are both responses to near-term policy uncertainty and long-term access to the world’s largest smartphone market.

Semiconductor rivals and partners are active: Broadcom (NASDAQ:AVGO) and OpenAI announcements, AMD (NASDAQ:AMD) deals, and Oracle’s (NYSE:ORCL) expansion of cloud superclusters all feed a multi-pronged demand signal for chips, networking, power conversion and system integration. Equipment firms from ASML to Lam Research have flagged stronger order backlogs tied to advanced-node and packaging demand.

“Key takeaways”

- “TSMC reported NT$452.3 billion (US$14.7 billion) in Q3 net profit, up 39.1% year‑on‑year; that is a quarterly record.”

- “Apple introduced M5 silicon with a 10‑core GPU and Neural Accelerators in each core, claiming over 4x peak GPU compute vs M4 and up to 3.5x AI gains on the 14-inch MacBook Pro.”

- “A BlackRock‑led consortium including Microsoft and NVIDIA agreed to buy Aligned Data Centers for about $40 billion, lifting demand for hyperscale capacity.”

- “Apple added 650 MW of renewables in Europe and is shifting some assembly to Vietnam while maintaining China investments under CEO Tim Cook’s outreach.”

Short term, the headlines drive ordering and capacity allocation across fabs, equipment makers and data‑center builders. Over the long term, the combined effect of AI compute needs and consumer product upgrades is increasing demand for advanced nodes, specialized packaging and power‑efficient system design. Investors and industry participants will watch capex cadence, shipment trends and policy moves to read how capacity and pricing evolve.