Apple hits all-time high as iPhone 17 sales surge

Apple (NASDAQ:AAPL) jumped to a record after reports showed iPhone 17 sales outpacing the prior-year iPhone 16, a timely boost to U.S. markets and global sentiment. In the short term the move lifted major indexes and chip suppliers. Over the long term it signals a stronger hardware upgrade cycle and upside for services revenue. The rally matters across markets: it lifted U.S. indices, reinforced chip demand in Asia, and countered softer handset trends in parts of Europe and India. The speed and breadth of the move recall past iPhone-driven market rallies but comes amid heavier focus on AI infrastructure.

Market Pulse Check

Investors piled into large-cap winners and ETFs on Monday, lifting the S&P 500 about 1.1% and the Nasdaq Composite roughly 1.4%, while the Dow added roughly 516 points. The SPDR S&P 500 ETF Trust (SPY) traded higher, up around 0.3% pre-bell, reflecting flows into passive exposures.

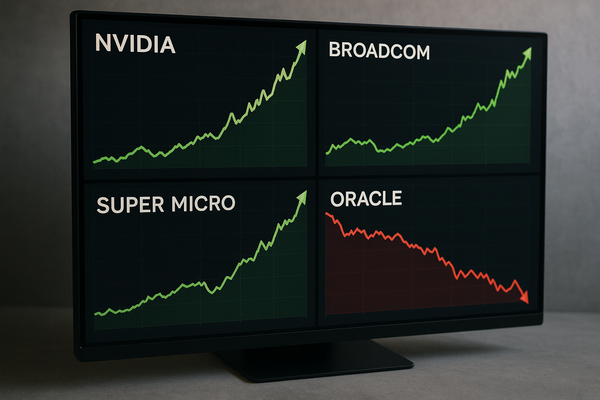

Apple (NASDAQ:AAPL) led the charge after Counterpoint-style sales data showed a 14% year-on-year lift in early iPhone 17 sales in key markets. That pushed Apple’s market value toward the $4 trillion mark, pulling index weights higher and helping Nvidia (NASDAQ:NVDA), Broadcom (NASDAQ:AVGO) and Super Micro Computer (NASDAQ:SMCI) rally as infrastructure demand expectations rose.

Meanwhile, an Amazon Web Services outage earlier in the day highlighted fragility in cloud-dependent operations but did not meaningfully dent the rally. Regional data signaled mixed demand: India’s smartphone market expanded modestly (~3% YoY), showing pockets of resilience even as some handset cycles cool elsewhere.

Analyst Convictions

Analysts diverged sharply this week. Banks and research houses pushed upgrades on select AI and infrastructure names while trimming coverage or flagging execution risks at some enterprise software and cloud players.

- Buy-side momentum concentrated on AI-capable infrastructure: Nvidia (NASDAQ:NVDA) and Broadcom (NASDAQ:AVGO) drew fresh attention after banks urged concentration on large-cap AI leaders. Broadcom’s shares have jumped more than 25% over recent months as investors reward perceived scale in AI networking and chips.

- By contrast, Oracle (NYSE:ORCL) drew a negative analyst note that cited higher capital spending tied to its AI expansion. JPMorgan-style skepticism pressured the stock, showing that strong AI positioning can still attract valuation scrutiny when financing and capex are in focus.

- KLA (NASDAQ:KLAC) and other semiconductor equipment names received selective upgrades from some firms, reflecting the view that wafer fab activity remains resilient even where end-market handset growth softens.

These moves illustrate a classic divergence: elevated conviction on leaders with clear AI scale vs. increased caution on firms where AI investment raises near-term financing or execution questions.

Risk Events vs. Expansion

Market action this week juxtaposed headline risk events with aggressive expansion stories.

- Risk events: Proxy advisory pressure and deal scrutiny surfaced in infrastructure M&A — ISS recommended investors reject CoreWeave’s bid for Core Scientific, underscoring governance friction around large AI-infrastructure deals. Separately, an AWS outage briefly disrupted many services, a reminder that cloud concentration presents systemic operational risk.

- Expansion stories: Several smaller and mid-cap names pushed into AI and data-center footprints. CleanSpark (NASDAQ:CLSK) announced an expansion into AI data centers and hired experienced data‑center leadership, a clear pivot from pure Bitcoin mining to broader infrastructure supply. Micron (NASDAQ:MU) reported adjustments to its China server-supply strategy, demonstrating how geopolitical and export considerations affect hardware flows.

The market awarded expansion where execution and customer demand were clear, while penalizing deals or strategies that raised governance or financing questions.

Leadership and Fundamentals

Leadership comments and corporate fundamentals also split the market’s view.

- Apple (NASDAQ:AAPL) CEO Tim Cook publicly praised China’s developer ecosystem, reinforcing a narrative that robust local app and supply‑chain activity supports device demand. That narrative fed both short-term share gains and a calmer view of global smartphone demand.

- IBM (NYSE:IBM) and other legacy software names leaned on AI bookings and subscription momentum to argue for steady fundamentals. Yet investors expect bookings to translate into revenue and cash flow, creating a gap between bookings headlines and immediate stock moves.

- Palantir (NYSE:PLTR) provided a study in divergence: strong commercial revenue growth and platform adoption contrasted with valuation debates — the stock’s price moves did not always mirror operational gains.

Where leadership tied strategy to measurable commercial traction, markets rewarded stocks. Where communication emphasized potential without immediate revenue translation, skepticism grew.

Investor Sentiment

Institutional flows and retail behavior split this week. Large-cap ETFs and passive funds absorbed inflows as indices rose, suggesting institutions sought broad exposure to the winners. Retail activity showed more concentrated bets on momentum names and select AI names, visible in outsized intraday volume around Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA) and Super Micro Computer (NASDAQ:SMCI).

Valuation disconnects appeared: some stocks with strong fundamentals lagged sentiment (e.g., names with steady bookings but downgrades), while high-conviction AI leaders traded at premium multiples driven by momentum. Options positioning and collar strategies also surfaced as traders looked to lock gains after recent runs.

Investor Signals Ahead

The week’s contrasts — upgrades for AI and infrastructure leaders, downgrades for firms facing rising capex or execution questions, and simultaneous M&A governance debates — suggest a near-term reshuffling of leadership. Investors are rewarding clear revenue delivery and scale in AI infrastructure and penalizing unclear financing or governance in large deals.

Signals to note: rising index leadership from a handful of mega-caps can narrow breadth, operational outages can trigger re‑examinations of cloud concentration, and proxy or regulatory friction can change the calculus on large infrastructure M&A. These are market signals, not forecasts, that help explain where flows and convictions are concentrating in the coming month.