Apple Harvests Demand — And Picks This Fight With Meta, Google. Apple (NASDAQ:AAPL) shows fresh signs of demand and a technical reset that have traders eyeing a move to a new all‑time high. Near term, stronger sell‑through and a technical rebound can fuel gains; longer term, Apple’s software and services push will determine whether hardware strength translates into sustained revenue growth. Globally, smart‑home and AI product cycles in the US, Europe and Asia are creating parallel demand drivers. Historically, the Dow’s tilt toward tech — adding Microsoft and Intel in the 1990s and Apple and Nvidia more recently — underlines how winners in hardware and AI can reshape index leadership. This matters now because product cycles, chip supply shifts and fresh enterprise AI launches are colliding in October 2025.

Why Apple’s momentum matters now

Apple’s stock has shown a technical reset and investor sentiment has lifted after a series of headlines referencing clear demand signals. Market commentary highlights a rebound in confidence that reduced some of the near‑term risk premium and put a fresh breakout into focus.

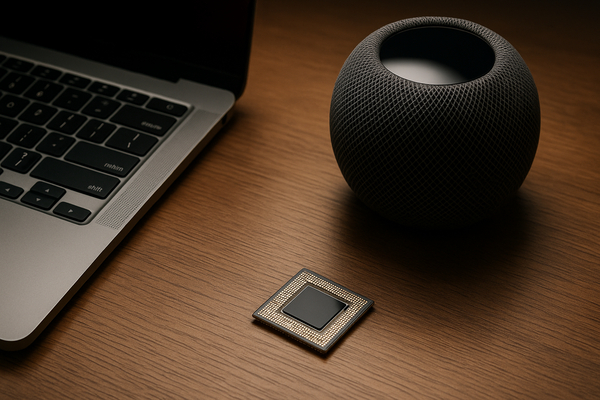

Several forces are converging. The smart‑home market research report names Apple (NASDAQ:AAPL) alongside Amazon (NASDAQ:AMZN) and Google (NASDAQ:GOOGL) as leaders as IoT, AI and 5G create retrofit and new‑build opportunities. For Apple, stronger iPhone sell‑through and accessory demand flow through Services and wearables. That helps margins and recurring revenue profiles in the short run, while long‑term returns will hinge on whether Apple converts device users into higher ARPU services customers.

Technical and macro context matters. The broader market environment — a softer Fed tone and renewed AI optimism — lifted US equities in Q3 and supported heavyweight tech names. The Dow’s transition toward technology over the last three decades offers a historical parallel: markets reward companies that control both hardware and software stacks.

Competitive flashpoints: AI agents and smart‑home markets

Apple faces intensified platform competition. Google (NASDAQ:GOOGL) rolled out Gemini Enterprise for businesses, aiming squarely at Microsoft (NASDAQ:MSFT) and enterprise AI workflows. Amazon Web Services (AWS) launched Quick Suite, a set of AI agents for workers that integrates with Slack and other enterprise tools. Meta (NASDAQ:META) continues to invest in AI and augmented reality functionality that targets the same user attention Apple seeks with its ecosystem.

These launches matter to Apple’s services strategy because enterprise AI winners can influence where developers and customers spend. Apple’s advantage remains its integrated hardware‑software experience, but enterprise AI platforms that prioritize cloud‑native data access can pressure margins for third‑party device makers.

Two market facts to note:

- Google and Amazon’s enterprise product launches accelerate enterprise adoption of agentic AI and create new channels for voice, assistant and device integration.

- Smart‑home growth creates a multi‑vendor opportunity set: device makers, cloud providers and chip vendors all capture slices of the value chain.

Supply chain and chip developments shaping product timing

Chip and factory news is tightly linked to product road maps. Intel (NASDAQ:INTC) unveiled the Core Ultra series 3 processor built on its 18A process and said Panther Lake will enter high‑volume production at its Arizona fab later this year. Intel quoted roughly 50% faster performance for Panther Lake graphics and processors versus its prior generation — a meaningful technical gain for PC OEMs and for partner ecosystems.

Nvidia (NASDAQ:NVDA) developments also influence the compute market. Reports indicate US export approvals could permit shipments to the UAE on the order of 500,000 AI chips per year — a large increment of global AI compute capacity if sustained.

On the materials and equipment side, Applied Materials and Arizona State University opened a $270 million Materials‑to‑Fab Center to accelerate prototyping and scaling. That kind of local R&D capacity matters to the semiconductor supply chain that Apple and others rely on.

Regulatory and legal moves create additional inputs. Qualcomm (NASDAQ:QCOM) faces a UK antitrust lawsuit; outcomes that constrain chipset licensing or pricing could ripple into smartphone component costs and partner mixes.

Top actionable takeaways

- Device demand and a technical reset have put Apple (NASDAQ:AAPL) in position for a short‑term breakout; monitor sell‑through data over coming weeks.

- Google’s Gemini Enterprise and AWS’s Quick Suite are accelerating enterprise AI adoption that can influence Apple’s services monetization path.

- Intel’s Panther Lake entering high‑volume production and Nvidia export approvals ease compute constraints that affect product timing across vendors.

- Smart‑home market expansion creates cross‑platform competition and new monetization channels for ecosystems that integrate hardware, software and services.

In addition to the items above, watch component and materials suppliers for signs of order cadence changes. MP Materials’ recent contracts with defense and corporate customers, plus supplier moves across the semiconductor stack, underscore how supply‑chain wins can feed product advantage. This is a dynamic phase where product cycles, enterprise AI deployments and chip supply developments will collectively influence near‑term momentum and longer‑term revenue mix.

Note: This article is informational and does not constitute financial advice.